Is your estate plan current and effective? Regularly evaluating your estate plan ensures it meets your latest needs and wishes. In this article, you’ll find a step-by-step estate planning checklist—a practical resource designed to simplify the process and ensure all necessary steps are covered—to help you evaluate your estate plan, review, and update it so that it protects your assets and honors your intentions.

Key Takeaways

- Regular reviews of your estate plan are essential to ensure it reflects your current wishes and personal circumstances, especially after significant life events.

- Beneficiary designations on financial accounts should be regularly checked and updated to align with your updated will, preventing potential disputes among heirs.

- Effective estate planning requires ongoing communication with family members and professional guidance to ensure all aspects, including legal documents and asset management, are properly addressed.

Importance of Regular Estate Plan Reviews

Regularly reviewing your estate plan ensures it reflects your current wishes and circumstances. Life is full of changes that can significantly impact your estate planning needs, including:

- Marriages

- Divorces

- Births

- Deaths

- Financial shifts

Regular reviews are particularly important for older adults, as their circumstances may change and it is crucial to ensure their wishes are fulfilled and their assets are properly managed.

Without regular reviews, you risk leaving outdated instructions that could lead to confusion and disputes among your beneficiaries. Updating your estate plan guarantees that your assets are distributed according to your current intentions.

Key aspects of effective estate planning include:

- Regularly reviewing beneficiary designations on your financial accounts, as they can override your will’s instructions and must match your current wishes.

- Discussing your estate planning with family members to help align everyone with your decisions and preserve the family legacy.

- Consulting an estate planning attorney for valuable guidance on updating your estate plan, ensuring all legal documents are accurate and reflective of your situation.

Review your estate plan every three to five years or after significant life events. This practice not only provides peace of mind but also helps avoid potential legal issues. An updated and comprehensive estate plan is your best defense against unexpected challenges, ensuring that your wishes are honored and your loved ones are protected. It’s essential to plan ahead to update your estate plan and ensure everything is in order.

Reviewing Beneficiary Designations

Beneficiary designations are a critical component of effective estate planning. Key areas where these designations should be checked and updated regularly include:

- Life insurance policies

- Retirement accounts

- Brokerage accounts

- Bank accounts. These designations can bypass probate, facilitating quicker asset distribution and minimizing potential disputes among heirs, especially for named beneficiaries.

It’s crucial that the beneficiary designations on your financial accounts match your updated will to prevent any conflicts. Regularly reviewing and updating these designations ensures that your assets are distributed according to your wishes and not based on outdated information. This simple but essential step can save your loved ones a lot of hassle and heartache in the future.

Assessing Changes in Family Dynamics

Family dynamics are constantly evolving, and your estate plan should evolve with them. Major life events such as marriage, divorce, the birth of a new child, or the death of a family member can significantly impact your life changes and estate planning needs that were created, including considerations for adult children and life event.

It is also crucial to name guardians for minor children in your estate plan to ensure they are cared for according to your wishes if something happens to you.

Such changes necessitate a thorough review of your legal document estate planning documents to ensure they reflect your current circumstances and wishes.

Evaluating Your Will and Trusts

As the cornerstone of your estate plan, your last will and testament details the distribution of your physical assets, personal possessions, and financial accounts. Regular updates ensure it reflects your current wishes and financial situation regarding money.

Establishing an irrevocable trust can be a strategic way to minimize estate taxes and protect assets for future generations.

Ideally, this review should occur every three to five years or after major life events.

Ensuring Proper Asset Titling

Proper asset titling is crucial in estate planning, determining how assets are owned and distributed. The names on deeds or titles can override your will’s instructions, so it’s important to ensure alignment with your estate plan.

Accurate asset titling helps avoid probate and ensures seamless asset distribution. For instance, listing a revocable living trust as the property owner on property deeds and titles streamlines asset distribution, protects your estate from legal complications, and facilitates a transfer on death. It is also essential to ensure proper titling for other real estate to guarantee accurate ownership transfer and avoid probate complications.

Updating Powers of Attorney and Healthcare Directives

Powers of attorney and health care proxy and advance healthcare directive are vital components of a comprehensive estate plan. Regularly updating these documents ensures they reflect your current preferences and appoint trusted individuals. A healthcare directive clarifies your medical treatment preferences, preventing family conflicts during critical situations.

A healthcare power of attorney designates someone to make medical decisions per your directive, while a financial durable power of attorney grants someone the legal authority to handle your finances, pay bills, and manage assets on your behalf during incapacity. A living will is a specific type of advance healthcare directive that states your end-of-life and medical treatment preferences, including decisions about resuscitation and life support. Keeping these documents current ensures your wishes are honored, and your affairs are managed appropriately in times of need.

Planning for Estate Taxes

Estate taxes can greatly impact asset distribution, so planning ahead is crucial. The federal government sets annual gift tax exclusions and regulates estate tax implications for individuals. A tax professional can help navigate complex estate tax regulations.

An estate planning attorney can assist in minimizing liabilities and maximizing protections for your estate.

Managing Digital Assets

In today’s digital age, managing digital assets is crucial for estate planning. Appointing a digital fiduciary ensures your digital assets are handled according to your wishes, and maintaining an updated inventory of these assets is essential.

Social media accounts can be memorialized or deleted after death, depending on your preferences. However, service providers often won’t disclose passwords of deceased persons, creating obstacles in accessing these assets. Including management instructions for these account assets in your estate plan helps avoid these issues.

Preparing for Long-Term Care Needs

Planning for long-term care is a crucial aspect of a comprehensive estate plan. Considering various settings like nursing homes, assisted living facilities, and in-home care helps you prepare for future healthcare needs. Long-term care insurance can cover these costs while preserving your assets.

Medicare typically offers limited coverage for long-term care, so individuals often need to rely on personal savings or long-term care insurance. Having several plans in place ensures financial preparedness for any changes in your health needs.

Avoiding Probate

Avoiding probate is a key goal for many people when developing an estate plan. Probate is the court-supervised process of validating a will and distributing assets, which can be lengthy, expensive, and public. Fortunately, there are several estate planning strategies you can use to help your beneficiaries receive their inheritance more quickly and privately.

One of the most effective ways to avoid probate is by creating a revocable living trust. With a revocable living trust, you can transfer ownership of your assets—such as real estate, bank accounts, and investment accounts—into the trust during your lifetime. Upon your passing, these assets are distributed directly to your named beneficiaries, bypassing the probate process entirely.

Another important tool is the use of beneficiary designations. Certain assets, like life insurance policies, retirement accounts, and some bank accounts, allow you to name beneficiaries who will receive the assets directly upon your death. Similarly, transfer-on-death (TOD) and payable-on-death (POD) designations can be added to brokerage accounts and bank accounts, ensuring a smooth transfer of funds outside of probate.

To determine the best approach for your unique situation, consult with an estate planning attorney. They can help you structure your estate plan to minimize delays, reduce costs, and ensure your wishes are carried out efficiently. By planning ahead, you can help your loved ones avoid the stress and expense of probate while protecting your legacy.

Storing Important Documents Safely

Storing important documents safely protects them from damage and ensures accessibility when needed. Use a water-resistant plastic pouch for protection and keep originals in a fireproof safe or a document safe deposit box.

Informing your executor and family members about the location of stored documents eases access during difficult times. Creating backup copies of essential documents at an alternate location is recommended to avoid losing access to originals.

Communicating Your Plan with Family

Communicating your estate plan with family members helps avoid confusion and conflict. To ensure your family understands your intentions, consider the following:

- Explain your decisions and reasoning.

- Provide information on where to find important documents.

- Share contact information for your attorney or financial advisor.

Discussing your funeral instructions, including personal burial preferences and additional wishes, can help your family during a difficult time. Discussing your healthcare wishes with your family and ensuring appointed agents are aware of your preferences is equally important.

Seeking Professional Legal and Tax Advice

Seeking professional legal or tax advice ensures your estate plan is comprehensive and legally sound. An estate planning attorney can help prevent costly mistakes from self-preparation. Experienced attorneys create customized estate plans tailored to your family’s unique needs and circumstances.

Maintaining a relationship with an estate planning attorney allows for timely updates to your will and estate plan as life events occur. If you have questions about your estate planning, meet with a qualified estate attorney to ensure your plan is thorough and accurately reflects your wishes.

Finalizing Your Estate Plan

Once you have reviewed and updated all aspects of your estate plan, it’s time to finalize the process to ensure your wishes are legally protected. Start by carefully reviewing each legal document—such as your last will and testament, revocable living trust, powers of attorney, and advance healthcare directive—to confirm that all information is accurate and up to date.

Make sure all documents are properly signed, witnessed, and notarized as required by your state law. Store your important documents in a secure, fireproof location, and let your executor, family members, or trusted advisors know where to find them. It’s also wise to provide copies to your estate planning attorney or financial advisor for safekeeping.

Communicate your estate plan to those involved, including your chosen agents, beneficiaries, and family members. Clear communication helps prevent misunderstandings and ensures everyone understands your wishes regarding asset distribution, healthcare decisions, and end-of-life care.

Finally, remember that estate planning is an ongoing process. Schedule regular reviews of your estate plan, especially after major life events or changes in your financial situation. By staying proactive and seeking professional legal or tax advice when needed, you can keep your comprehensive estate plan current and effective, providing peace of mind for you and your loved ones.

Summary

In summary, regularly reviewing and updating your estate plan is essential to ensure it reflects your current wishes and circumstances. From reviewing beneficiary designations to managing digital assets, each step is crucial in creating a comprehensive estate plan that protects your legacy and provides for your loved ones. Take action today to review and update your estate plan, and seek professional advice to ensure your plan is robust and legally sound.

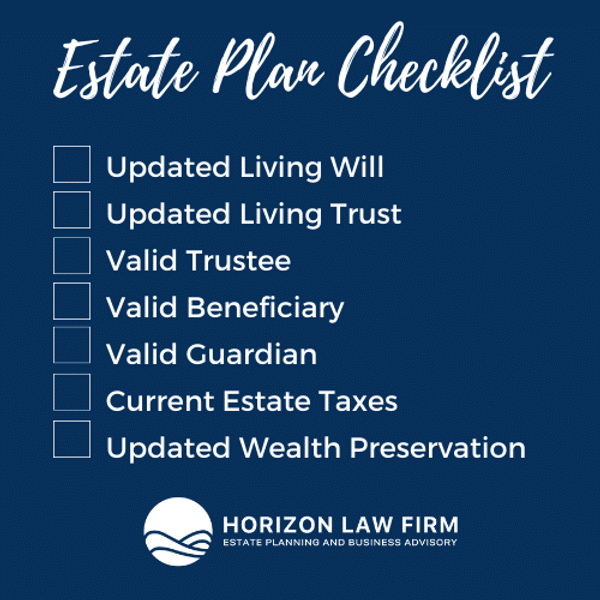

How good is your estate plan? Check out our Estate Plan Checklist. Missing any of these items? Reach out to Horizon Law Firm.